Why Hydrogen is not the “one and only” solution for future mobility …

How does a hydrogen car work? The whole world is talking about electric cars. Aren’t there still alternatives? Besides internal combustion engines and battery electric vehicles, there is still a gap – that of hydrogen cars.

Many articles are referring to Hydrogen as the future for passenger cars. The hydrogen fuel cell electric vehicle (FCEV) runs on pressurized hydrogen from a fueling station instead of energy stored in a big battery pack. It produces zero carbon emissions from its exhaust. It can be filled as quickly as a fossil-fuel equivalent and offers a similar driving distance to petrol (that most battery powered electric vehicles currently don’t achieve).

Automotive OEMs around the world see the technology differently. Asian manufacturers in particular already have the first models in their product range, while many others are hesitant. The European premium OEMs have at least been looking at the topic for many years meanwhile. BMW, for example, has integrated hydrogen-powered vehicles as a fourth pillar in its “Power of Choice” strategy as part of their product strategy – although they still need some more years for series production readiness.

But are hydrogen-powered fuel cell vehicles really an alternative for future mobility? Will we power passenger vehicles with hydrogen? Let’s have look.

The Technology: Hydrogen Fuel Cell

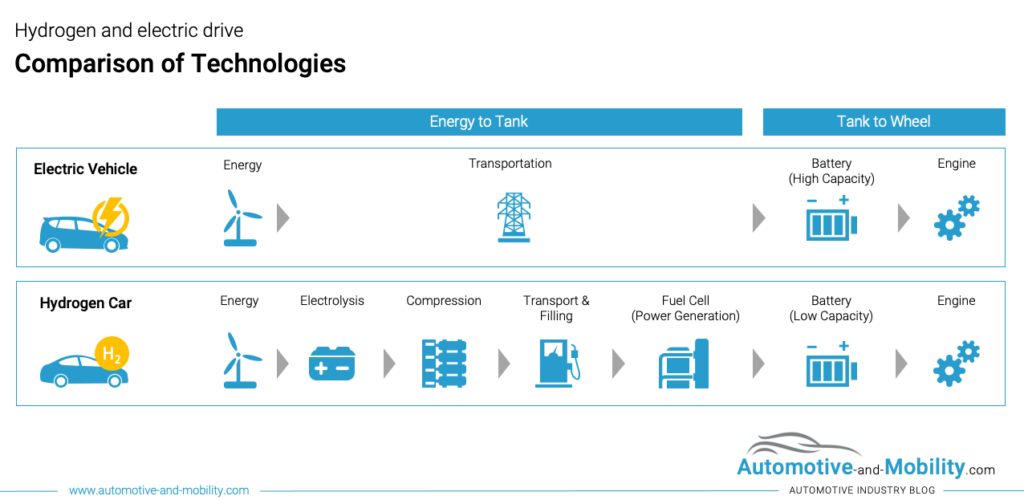

Let’s take a look at how hydrogen propulsion works. Basically, the term “hydrogen car” is wrong. It should actually be called a fuel cell vehicle. And one step more accurately, fuel cell cars are actually electric cars. The whole thing works like this: In such a vehicle, a fuel cell with a hydrogen tank is installed. This generates electricity for driving. However, the electricity does not have to be stored, as in the case of a pure electric car, but is produced when the electricity is needed – while driving. A small battery is nevertheless present, which serves as a buffer and cushions peak loads. These load peaks can be strong acceleration, for example. In addition, the battery can store recuperation energy, i.e., the recovery of electricity from braking energy.

The fuel cell itself generates electricity from hydrogen using the principle of reverse electrolysis. Anyone who paid close attention in school knows that hydrogen and atmospheric oxygen become water in a chemical reaction. This produces two “waste products”: Heat and electricity. The latter drives the electric motor. The heat is actually a product of the chemical reaction that must be controlled. For this reason, fuel cell vehicles must also be particularly well cooled and usually have large air inlets.

A PEM, a polymer electrolyte membrane, operates in the fuel cell. This separates hydrogen and atmospheric oxygen, each of which flows around an anode and cathode, respectively. The membrane is only permeable to hydrogen ions, so hydrogen molecules separate into ions and electrons. The hydrogen ion thus migrates through the membrane to the cathode, where it combines with the atmospheric oxygen. The end product: water! For hydrogen electrons, however, the membrane is impenetrable, so they have to take the “long” way from the anode to the cathode. And the resulting product is the desired current! So instead of exhaust gases, a hydrogen car produces simple water in addition to energy.

Fuel cell and battery-powered vehicles in energy and ecology comparison

Hydrogen generated from renewable energies will certainly be an essential part of the solution to future energy problems. But does this also apply to mobility? Volkswagen for the moment does mainly concentrate on electric mobility, meanwhile, made a statement comparing the energy efficiency of the technologies. “The conclusion is clear” said the company. “In the case of the passenger car, everything speaks in favour of the battery and practically nothing speaks in favour of hydrogen.”

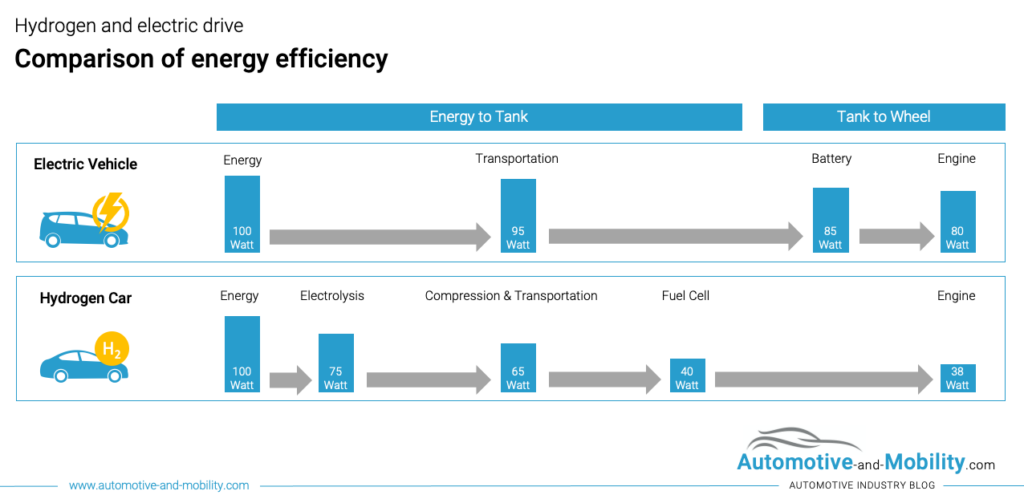

The reason why hydrogen is inefficient is because the energy must move from wire to gas to wire in order to power a car. Let’s take 100 watts of electricity produced by a renewable source. To power an FCEV, that energy has to be converted into hydrogen, possibly by passing it through water (the electrolysis process). This is around 75% energy-efficient, so around one-quarter of the electricity is automatically lost.

The hydrogen produced has to be compressed, chilled and transported to the hydrogen station, a process that is around 90% efficient. Once inside the vehicle, the hydrogen needs converted into electricity, which is 60% efficient. Finally the electricity used in the e-engine to move the car is around 95% efficient. Put together, only 38% of the original electricity – 38 watts out of 100 – are used.

With electric vehicles, the energy runs on wires all the way from the source to the car. The same 100 watts of power from the same turbine loses about 5% of efficiency in this journey through the grid. A further 10% of energy gets lost from charging and discharging the battery, plus another 5% from using the electricity to make the car move. In total you are down to 80 watts. In other words, the hydrogen fuel cell requires double the amount of energy.

The Canadian Hydrogen and Fuel Cell Association recently produced a report extolling hydrogen vehicles. Among other points, it said that the carbon footprint is an order of magnitude better than electric vehicles: 2.7g of carbon dioxide per kilometre compared to 20.9g. But this comparison is non-sense, as it simply is based on comparing hydrogen made from purely renewable electricity with electric vehicles powered by electricity from fossil fuels.

What about market readiness?

The very first fuel cell-powered vehicle, the GM Electrovan, was tested on U.S. roads way back in 1966. The system was supported by NASA development during the space race period and involved several advances in fuel cell technologies.

Fuel cell development has come a long way since then. Following the 1992 Energy Policy Act, hydrogen is considered an alternate fuel and is thus eligible for tax credits. And since fuel cell electric vehicles or FCEVs are powered primarily by hydrogen, this proves to be a considerable boost to fuel cell market growth.

Fuel cell technology is gaining momentum rapidly in the automotive sector, as is evidenced by a series of deals among prominent industry players. Renowned power firm Cummins, known for its legendary diesel engine technology, recently acquired Canadian fuel cell manufacturer Hydrogenics in a $290 million deal. Meanwhile, in Italy, truck manufacturer CNH Industrial NV, backed by billionaire family Agnelli, greenlighted an investment of $250 million towards Nikola Motor, a startup firm working towards the deployment of hydrogen powered semi-trucks. Furthermore, in April, the world’s largest auto-parts manufacturer, Robert Bosch revealed plans to partner up with Powercell Sweden to initiative mass production of fuel cells by 2022.

Some sources foresee a dramatic growth of nearly 70% per year throughout the next years due to the rise in demand for personal mobility and increasing per capita income in the emerging markets. Based on the current very small market sizes between 10k and 20k vehicles per year globally, this can become reality still without becoming a market dominant factor. At least some countries announced investments in this area, e.g. South Korea is aiming to have 120,000 fuel cell taxies on the road by 2040. In addition, various taxi fleet manufacturers such as Hype (France) are currently selecting fuel cell cars.

As of now, the largest markets for fuel cells are Japan, China, and South Korea. Moreover, the region is home to leading OEMs such as Toyota, Hyundai, and Honda. These companies are planning to invest heavily in expanding their production capability and promote fuel cell vehicles. For instance, Hyundai is planning to invest USD 6.7 billion to enhance its fuel cell output and increase production capacity by more than 200-fold by 2030.

Today, the product range is still limited. Toyota will launch the second-generation Mirai in March 2021, which will use fuel cell technology to travel 650km with a 134 kW electric motor at a base price of EUR63,900. Globally, Toyota aims to sell 30,000 Mirai per year, 2500 in Europe, which is ten times more than before, but still very few: in 2019, just 85 Mirai were registered in Germany. The Hyundai Nexo is the second model already available in Germany today. It manages 540 km of range and costs EUR 69,000.

In addition to the Asian manufacturers, it is primarily the European premium manufacturers who are working on fuel cell vehicles and thus hope to be able to launch models suitable for long-distance travel in the high-price segment in the next few years. One example is BMW, which had already presented the “i Hydrogen Next” in 2019 as a concept based on the X5 (with a planned SOP for 2023). There are similar developments from Daimler and Audi as well.

BMW is working closely with an Asian manufacturer on this: The BMW Group and Toyota Motor Corporation joined forces in 2013 to co-develop a drive system using hydrogen fuel cell technology. Since the summer of 2015, the BMW Group’s research wing has been testing a small fleet of prototype BMW 5 Series GT hydrogen fuel cell vehicles powered by a jointly developed drive system with a Toyota fuel cell stack.

In 2016, the two companies signed a product development partnership agreement. Since then they have been working together on future generations of fuel cell drive systems and on scalable, modular components for hydrogen fuel cell vehicles. The alliance with Toyota Motor Corporation shows how the BMW Group has intensified its efforts to develop alternative drive technologies for fully emission-free driving. The two partners have great faith in fuel cell technology and will continue to work together to develop it further as the infrastructure and mass market grow around the world.

Mercedes is not far behind in the fuel cell game; it is gearing up for the limited release of its revolutionary plug-in/fuel cell hybrid technology GLC F-Cell. The device is expected to facilitate smooth operations without concerns about H2 station proximity.

Currently, the biggest shortcoming of hydrogen fuel cell cars is the sparsity of options for refueling. A hydrogen engine is refueled at special fuel pumps, which in the future will probably find their way into ordinary service stations. As things stand, however, there are still very few refueling stations for hydrogen-powered cars. At the end of 2019 there are only around 40 in the U.S., as compared to approx. 80 in Germany.

BMW’s homeland of Germany leads the way in terms of infrastructure for hydrogen fuel cell cars. In order to promote the expansion of refueling infrastructure there, vehicle manufacturers like BMW have joined forces with hydrogen producers and filling station operators in the Clean Energy Partnership initiative, which plans to expand the hydrogen fueling station network to 130 stations by 2022. That would allow the operation of about 60,000 hydrogen cars on Germany’s roads. The next target, with a corresponding increase in fuel cell vehicles, will be 400 stations by 2025.

Conclusion: Promising prospects – but really for cars?

However, hydrogen offers very promising prospects – although not for cars: Science is largely in agreement on this issue, as several recent studies have shown. The German Federal Ministry for the Environment, for example, assumes that hydrogen and synthetic fuels, so-called e-fuels, will remain more expensive than an electric drive, as more energy is required for their production. The Agora Verkehrswende (German traffic transformation) initiative also points out that hydrogen and e-fuels do not offer ecologically sound alternatives without the use of 100 percent renewable energies, and that, given the current and foreseeable electricity mix, the e-car has by far the best energy balance. In the view of the Fraunhofer Institute, synthetic fuels and drive technologies such as hydrogen in combination with the fuel cell will indeed play a role – but not so much in the passenger car sector, but rather in long-distance and heavy-duty traffic, as well as in rail, air and sea transport. From every angle of the environmental balance sheet, everything speaks for the battery-powered e-car. The technology is mature and ready for the mass market. The number of models is growing steadily. And with the battery-powered e-car, driving remains affordable. Current e-models are already at the price level of comparable combustion engine models. In contrast, the hydrogen car will always remain more expensive than the battery car – due to the complex technology and high fuel costs. Drivers already pay around nine to twelve euros per 100 kilometers for a hydrogen car, while battery cars cost only two to seven euros per 100 kilometers (depending on electricity prices in individual countries). And the topic of long-distance travel? That will soon no longer play a role. With the new generation of e-cars, ranges will increase to 400-to-600 kilometers, while charging will become increasingly faster on the one hand – and on the other hand, swap concepts for battery exchange during a short charging stop still are in progress of being developed and show a big potential to really make e-mobility useable for everyone.

Others share my opinion: Read this blog post from Mario Heger already in 2019 – https://thelastdriverlicenseholder.com/2019/01/01/is-the-fuel-cell-a-dead-horse/