New survey format: BearingPoint trend barometer e-mobility

Today, BearingPoint did publish its first “trend barometer e-mobility” as a new survey format that will be updated with the same questionnaire on a regular base. It’s targeting to the German market, so it’s in German but I want to share with you the major insights from this first online survey with 2,016 participants that did take place during February 2021.

Key take aways

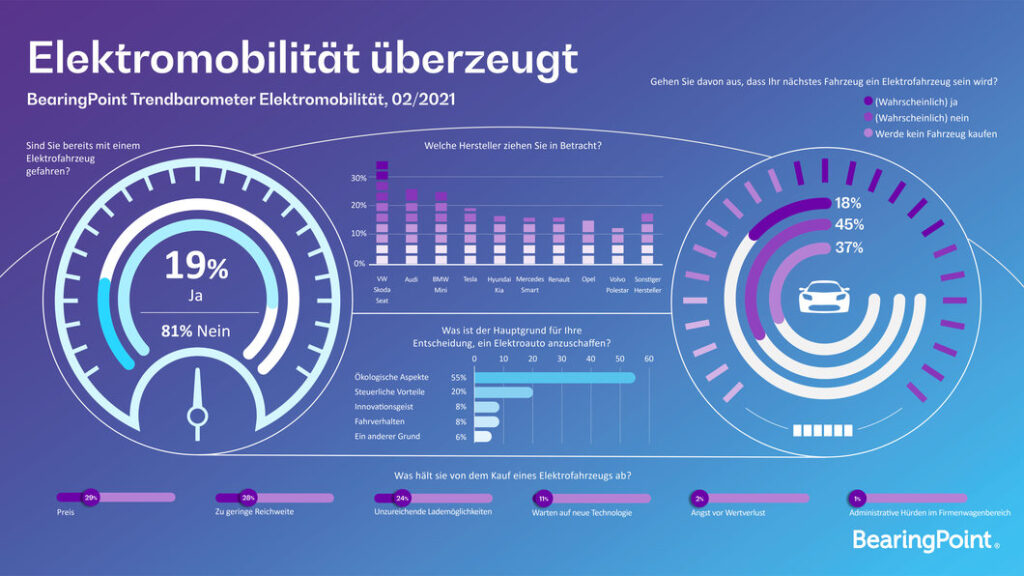

E-mobility is winning over more and more people. Almost one in five Germans has already driven an electric car or plug-in hybrid, and one in four of those aged 25 to 34. And one in three of those who have already experienced the thrill of driving an electric car are likely to buy an electric car or plug-in hybrid the next time they go shopping for a car. These and other figures from the new Trend Barometer by management and technology consultancy BearingPoint show that despite existing reservations about the new technology, the topic of e-mobility is gaining interest for more and more potential customers.

The experience of driving an e-car leaves an impression. Among people who have already driven an e-car, a significant proportion also want to buy one. Based on a share of e-cars of only around 14 percent of total registrations in Germany in 2020, pure electric vehicles and plug-in hybrids therefore still have enormous growth potential.

Dr. Stefan Penthin, Partner at BearingPoint

Why E-Mobility and why not?

The BearingPoint survey makes it clear that the respondents’ own experience with an e-car plays an important role in their choice of future car. While only 18 percent of respondents in general expect to buy an electric car when they next buy a car, the situation is somewhat different among the group of e-car experts – i.e. those who have already driven an electric car. This is because one in three of them expects to choose an e-vehicle or a plug-in hybrid when they next buy a car. One in five of this group would not buy a car at all in the future.

At 42 percent, purely battery-powered electric vehicles (BEVs) are almost on a par with plug-in hybrids (PHEVs) at 44 percent among potential e-car buyers. Among those who want to purchase an electric vehicle, a majority of 55 percent cite ecological aspects as the main reason. Tax reasons are decisive for only 20 percent. Other reasons are innovation and driving experience, each with 8 percent.

Those who decide against buying an electric car or plug-in hybrid cite high price (29 percent), insufficient range (28 percent) and insufficient charging options (24 percent) as the main reasons.

Volkswagen group’s marketing seems to convince

Among those surveyed who expect to buy an electric car, the Volkswagen Group is particularly popular. 35 percent could imagine buying a car from the VW, Skoda and Seat brands, followed by the VW Group subsidiary Audi with 25 percent. BMW is close behind with 23 percent. Tesla, on the other hand, is only in fourth place in the survey with 19 percent, and Mercedes Benz (14 percent) is only in sixth place. Of course, the purchase prices also play a role here, because among the top earners in the survey, one in two could imagine buying a Tesla, followed by Mercedes with 34 percent.

Original BearingPoint press release: https://www.bearingpoint.com/de-de/ueber-uns/pressemitteilungen-und-medienberichte/pressemitteilungen/einmal-e-auto-immer-e-auto/

Pingback: Is e-mobility a developed markets phenomenon? What about the rest of the world? - automotive-and-mobility.com